Bunnie Portfolio: Globetronics Technology Berhad

Wednesday, June 07, 2006

GTRONIC(7022) Main Board Technology

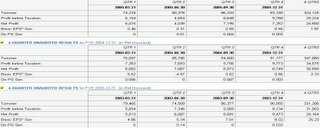

Globetronics Technology Bhd is involved in providing integrated, specialised, and advanced technology-based electronic manufacturing services.

Total issued shares: 1,310 million

Free Float about 25%

Major shareholders: Wiserite SB 23.4%, EPF 14.9%, Lembaga Tabung Haji 3.8%

Dividend payout had been quite consistent. At RM0.30 , PE is 16 and Divident Yield is 6%. Not a feasible investment fundamentally.

However, let’s take a look at the chart:

Cut loss price: RM0.27

Target price: RM0.36

Profit potential : +20% Downside risk : -10%

posted by winpulse @ 9:06 AM,

![]()

![]()