Tortie Portfolio: 10/8/2006 Update

Friday, August 11, 2006

The cash rich portfolio purchased BKAWAN, SCICOM and KOSSAN on 3/8/2006, 7/8/2006 and 7/8/2006 respectively. All intended for medium to long term holding, at least initially.

However, sensing that the market is wanting a correction badly, FEAR began to creep in. Seeing that both SCICOM and KOSSAN's price movement showing a weakness, our acting managing director sold them, again for a small profit.

MAYBULK is another story: the stock made a nice rally, with both price and volume breakout on 8/8/2006. The next morning, again, weakness in upwards movement was sensed. So, our acting managing director decided to take profit. 11.7%, not too bad. But that didn't stop our acting managing director from banging his head when the buying interest surged on that afternoon and pushed the price to RM2.40, which is the immediate resistance level, before closing at RM2.37. MAYBULK failed to break RM2.40 again on 10/8/2006, with slightly contracted volume. (The price reached RM2.42 very briefly in the morning, but retraced soon after that).

posted by winpulse @ 1:53 PM,

,

![]()

![]()

Tortie Portfolio : Atypical 'Head and Shoulder'

While monitoring the share price movement of Maybulk, I noticed an atypical

'head and shoulder' pattern of the stock which was formed early this year.

From February to March, it looks like a 'failed head and shoulder' which was unable to

break through the neck line. That resulted in the subsequent 'second head' (?) (Any

better suggestion?) in April. However, the neck line was broken on 19.4.2006, the very

ex-date of the fat dividend. And the subsequent decline corresponded quite well with the

predicted range (Well, textbooks say 'at least', but you can not expect real life to be so

mechanical, right?) The whole 'thing' took 4 months to complete, followed immediately by

a healthy rebound and recovery. This is fair to a good stock like Maybulk.

I think this is an interesting case study for technical analysis. Everybody with slightest

knowledge of technical analysis knows 'head and shoulder' (not that anti-dandruff shampoo).

But recognition in the real life could be a challenge. Some might not agree that it was a

variance of ''head and shoulder', some might agree with me. The point is, whether one can

see the pattern and use that recognition to correctly predict the subsequent price movement? That's the whole idea of Technical Analysis, right? :)

posted by winpulse @ 1:49 PM,

,

![]()

![]()

Tortie Portfolio Review: 28.7.2006

Monday, July 31, 2006

Our acting managing director sold half of tortie's position on 17.7.2006, wrong move!

Subsequently, after the panic had settled, Tortie bought Pelikan on 20/7/2006 at RM2.96 and CYMAO at RM0.955 at 21/7/2006. Cash balance is RM13791.81 at this moment. Tortie may increase exposure to SUIWAH, and may repurchase PBB.

To date, the portfolio value is RM50451.81, a mere 0.9% gain. A dissappointing underperformance. Let's hope for a better tomorrow :)

posted by winpulse @ 10:20 AM,

,

![]()

![]()

Tortie Portfolio: Plenitu - 11July2006

Thursday, July 13, 2006

PLENITU (5075) closed high at RM1.49 today, achieving a stunning 22% half year gain. Its highest price on 2006 was RM1.72 on the 3/5/2006, which was a nice-looking market condition before the global market adjustment. Follow by the correction, PLENITU dropped to RM1.33 and then has bounced back and still at its uptrend now.

Despite the RHB research today has downgraded call for PLENITU from BUY to HOLD based on the underweight stance and expectation on an imminent economic slowdown in 2007, we still maintain our BUY call for medium and long term. The reason is simple: strong balance sheet (RNAV of RM4.21, PE of 4, healthy EPS growth), attractive cash-in-hand (RM0.44/share) and enormous land bank (can keep the company busy for next 10-15 years).

Yesterday, PLENITU has just acquired RM25.96m worth of land at Pulau Penang. We see this as a proof that PLENITU is still keep on its strategy of accumulating land banks for future development. With a huge land bank, the future profits should be more guaranteed and sustainable. Based on the RHB research, due to its previous abandon status, the land was sold at 13% cheaper than the estimated market value. Moreover, PLENITU will not assume any liabilities from the previous project. This land is definitely a good buy.

posted by winpulse @ 12:46 PM,

,

![]()

![]()

Bunnie Porfolio: 4th of July 2006

Wednesday, July 05, 2006

| BUNNIE | (Started at RM20,000 AT 6/6/06) | (4/7/2006) | |||||||

| COUNTER | DATE PURCHASED | PR | AMOUNT | TOTAL | BALANCE | MKT PRICE | PROFIT/ LOSS | ||

| 1 | GTRONIC | 6/6/2006 | 0.30 | 10000 | 3016.80 | 10000 | 0.32 | 183.2 | |

| 2 | MAYBANK-CA | 20/6/2006 | 1.04 | 3000 | 3138.35 | 3000 | 1.13 | 251.65 | |

| 3 | LEADER | 22/6/2006 | 0.395 | 10000 | 3972.17 | 10000 | 0.405 | 77.83 | |

| 4 | JAKS | 22/6/2006 | 0.525 | 10000 | 5280.15 | 10000 | 0.545 | 169.85 | |

| 5 | MIDF | 4/7/2006 | 1.00 | 4000 | 4022.40 | 4000 | 1.00 | -22.4 | |

| TOTAL | 19429.87 | 660.13 | |||||||

| CASH BALANCE | 570.13 | 3.30% | |||||||

posted by winpulse @ 2:39 PM,

,

![]()

![]()

Investment - 4 - Dummies: STAOW & Investment Part I: Rule Number One

Monday, July 03, 2006

I don't know if Warren Buffet had ever studied Sun-Tze Art of War. But his key saying of

posted by winpulse @ 9:01 AM,

,

![]()

![]()

Bunnie Portfolio: Maybank-CA or Maybank-CB?

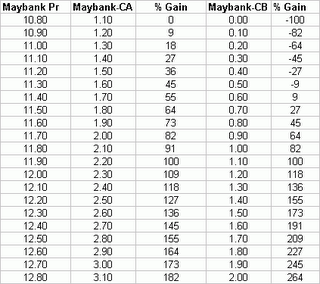

| Ex-Price | Mkt Pr | Maybank Pr | |

| Maybank-CA | 9.70 | 1.10 | 10.60 |

| Maybank-CB | 10.00 | 0.55 | 10.60 |

At a glance, Maybank-CB appears to offer a gearing of >20, which is double that of CA.

However, it is more likely to be an illusion.

Let's consider the 'what-if' situation of various Maybank prices and calculate the value of the options.

Premiums are ignored to simplify the calculation.

From the table, it appears that Maybank-CB offers slightly better return only when Maybank's price is more than RM12.00.

Given the short expiry date of both warrants, WINPULSE is of opinion that Maybank-CA is the better choice.

posted by winpulse @ 8:49 AM,

,

![]()

![]()